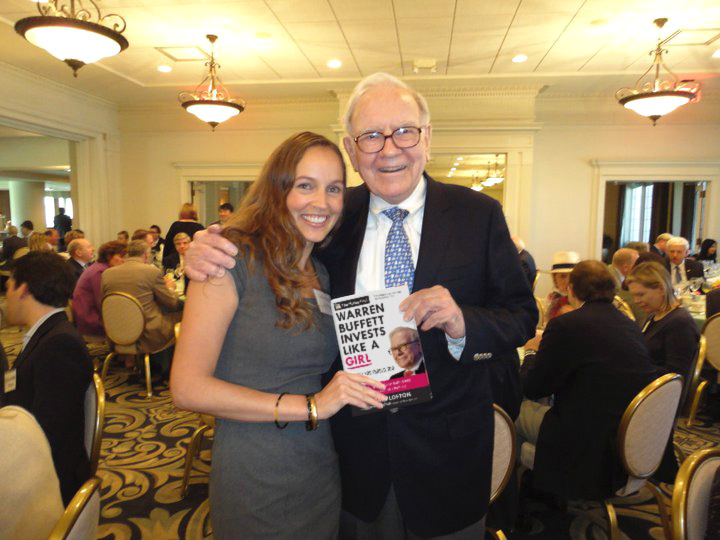

Last week was a big week for us here at The Motley Fool! We celebrated FoolFest, our annual member event, with over 300 Fools that traveled far and wide. In addition to breakout sessions, panel discussions, and fun meet and greet opportunities, we were also lucky to hear from some dynamic speakers.

FoolFest introduced us to the bestselling authors behind interesting ideas like the science of habit; rethinking situations that cause financial stress; and six commonalities of entrepreneurial success. So what exactly are these books and who are their authors?

1. The Power of Habit by Charles Duhigg

Charles Duhigg, award-winning New York Times reporter, explores scientific discoveries behind why habits exist and how they can be broken in The Power of Habit.

To overcome habits, Duhigg says that you must understand the cues that trigger it; the routine that fulfills it; and the rewards – or feelings – that you receive from it. Duhigg explained the cycle with his own example of eating a cookie every afternoon. By learning to analyze this daily action, he realized that it wasn’t the actual chocolate chips he craved – it was the social interactions in the cafeteria. A certain time in the late afternoon was his cue and, once he understood this habit, Duhigg set out to reconstruct it. Instead of heading to the cafeteria, he now finds colleagues to chat with around his desk. With his new routine, Duhigg hasn’t had a cookie in over 6 months.

Though habits are certainly personal, businesses also use the science of habit to influence what consumers buy. They collect data based on where customers live, household incomes, marital status, and whether or not a shopper has children. Stores like Target can then predict times that will most influence these customers to use coupons or see advertisements.

Do you think you could change your habits? Duhigg argues, “The key to exercising regularly, losing weight, raising exceptional children, becoming more productive, building revolutionary companies and social movements, and achieving success is understanding how habits work.” This book offers a helpful perspective if you’re curious to reform your routine.

2. The Creator’s Code by Amy Wilkinson

It took five years for Amy Wilkinson – strategic advisor, entrepreneur, and lecturer at Stanford University – to write her first published book. In The Creator’s Code, Wilkinson shares academic research along with six essential skills that have turned small concepts into big companies. Over 200 interviews and examples from corporations including PayPal, Airbnb, Tesla Motors, and Dropbox support Wilkinson’s list of traits that lead to great entrepreneurship .

What’s Wilkinson’s bottom line? Anyone can attain entrepreneurial success but it takes hard work. One of the skills that Wilkinson focused on during her FoolFest interview was “Failing Wisely.” She’s passionate about the importance of placing small bets to test ideas and build resilience. She said to the audience, “The people who can be very comfortable about experimenting and testing through are the ones who will succeed.” Whether it’s on our marketing team or among Member Service Fools, we’re constantly testing ideas at The Motley Fool. We, too, believe in consistent testing to find big wins among little mistakes.

3. The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money by Carl Richards

Emotions are easy to relate to finance. Debt causes stress for a lot of people, as do major financial decisions like buying a home or paying college expenses. Carl Richards argues that emotion interferes with making smart financial decisions, and he defines “the behavior gap” as the phenomenon between what we should do and what we actually do.

One of the best takeaways from Richards’ presentation was the importance of timing. Should you really be talking about finances with your partner first thing when you get home from work? Probably not. Why? Because you’re tired. Make financial decisions a discussion when you’re energized and clear-minded, or else you’re not setting the situation up for the smartest results.

Have you read these picks? Let us know by tweeting @FoolCulture!